Elizabeth Street, fashion & wellness for inspirational women

Browse the Book

Style (with substance). Beauty (inside and out). Diet (Healthy with a little naughty). Self-Care (Self Love).

Hi ladies, Nikki here!

I had a startling revelation a few years ago, that women regularly talk rather negatively about themselves (and sadly often about other women too).

It really fired me up to be a cog in the wheel of changing this perplexing dynamic. At Elizabeth Street I promise to only inspire and uplift women, by helping them to find their personal style while promoting self-care and pride in who they are.

We believe in lifting other women up and encourage you to not compare life with others, but to go through your own metamorphosis in life in your own beautiful uniqueness.

We update our blog twice a week to connect, motivate and ignite sparks of creativity and confidence in your life.

You’ll also love

Style (with substance). Beauty (inside and out). Diet (Healthy with a little naughty). Self-Care (Self Love).

- Say Goodbye to Traditional Braces: Why Invisalign in Winnipeg Is the Modern Solution You NeedIn the heart of Canada lies Winnipeg, famous for its history, diverse culture, and progressive outlook. As the capital of Manitoba, this city is home to a dynamic population that …

- The Path to Perfection: Aesthetics Training Expert TipsEmbarking on a journey to become an aesthetics practitioner requires dedication, passion, and a commitment to excellence. Aesthetics training is a crucial step in this journey, providing you with the …

The Path to Perfection: Aesthetics Training Expert Tips Read More »

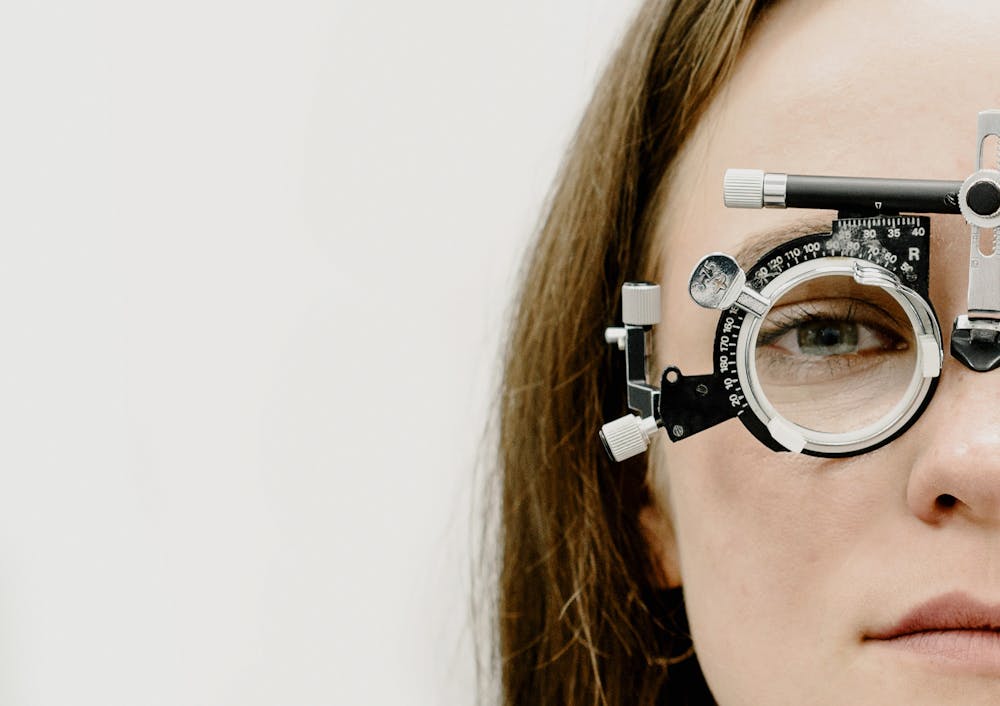

- Tips for Eye Health and Maintaining Good EyesightIn the digital age, where screens dominate much of our daily lives, maintaining good eye health is more crucial than ever. Did you know more than 12 million people above …

Tips for Eye Health and Maintaining Good Eyesight Read More »